FAQ

FREQUENTLY ASKED QUESTIONS

Answers from Abogado Push

Straightforward answers to common questions

This FAQ covers many of the questions I get on a day to day basis! I have made it a little less boring for your enjoyment!

Personal INJURY questions

Isn’t my attorney supposed to be on my side to make sure I don’t get taken advantage of my medical liens?

Yes, contact me. So, I can start helping your small business!

What should I do after a car crash in Florida?

1. Remain at the scene. Don’t admit fault.

2. Find a safe location, call the police, and exchange driver information.

3. Call 305 409 4900 right away.

How long do I have to file an injury claim in Florida?

As soon as possible! The law says generally it is 2 years.

What is a contingency fee for personal injury?

You pay no upfront attorney fee. The percentanges are clearly explained in the retainer agreement that you sign.

Can I recover compensation if I was at fault?

No, unless you have Uninsured/Underinsured motorist coverages!

TAX and Money questions

How long does it take to save $100,000?

It takes about 10 years. You can do it in 5-7 years based on your income!

What do I need to know about taxes?

The IRS helps U.S. citizens save money for retirement mainly by rewarding long-term saving with tax advantages. In simple terms: if you save for retirement, the tax code treats you better.

How long does it take to start getting financially healthy?

Most people start feeling financially healthier within 3–6 months, and reach strong stability in 2–3 years—if they’re consistent!

What is an HSA?

An HSA is a Health Savings Account—one of the most powerful (and often misunderstood) tools for saving money on healthcare and taxes.

Why can't I save money?

Discipline

Which accountant's do you work with?

Emerge180

13902 N Dale Mabry #229

Tampa, FL 33618

(813)-341-0503

Federal Hill Income Tax

📞 (410) 547-0285

📧 info@federalhillincometax.com

📍 Nottingham Office/ Virtual Appointment

Carlos M. Rivero, CPA

Contador Publico Autorizado

Rivero Consulting LLC

cmrivero@riveroconsulting.com

Web: www.riveroconsulting.com

Telephone. (787) 647-7311

Working with Money

What is the long term return for 40 year investment?

Every 40 years, investment in the market can yield a 1340% increase → roughly 14.4 which is about 6.9% annual compound rate of return over 40 years!

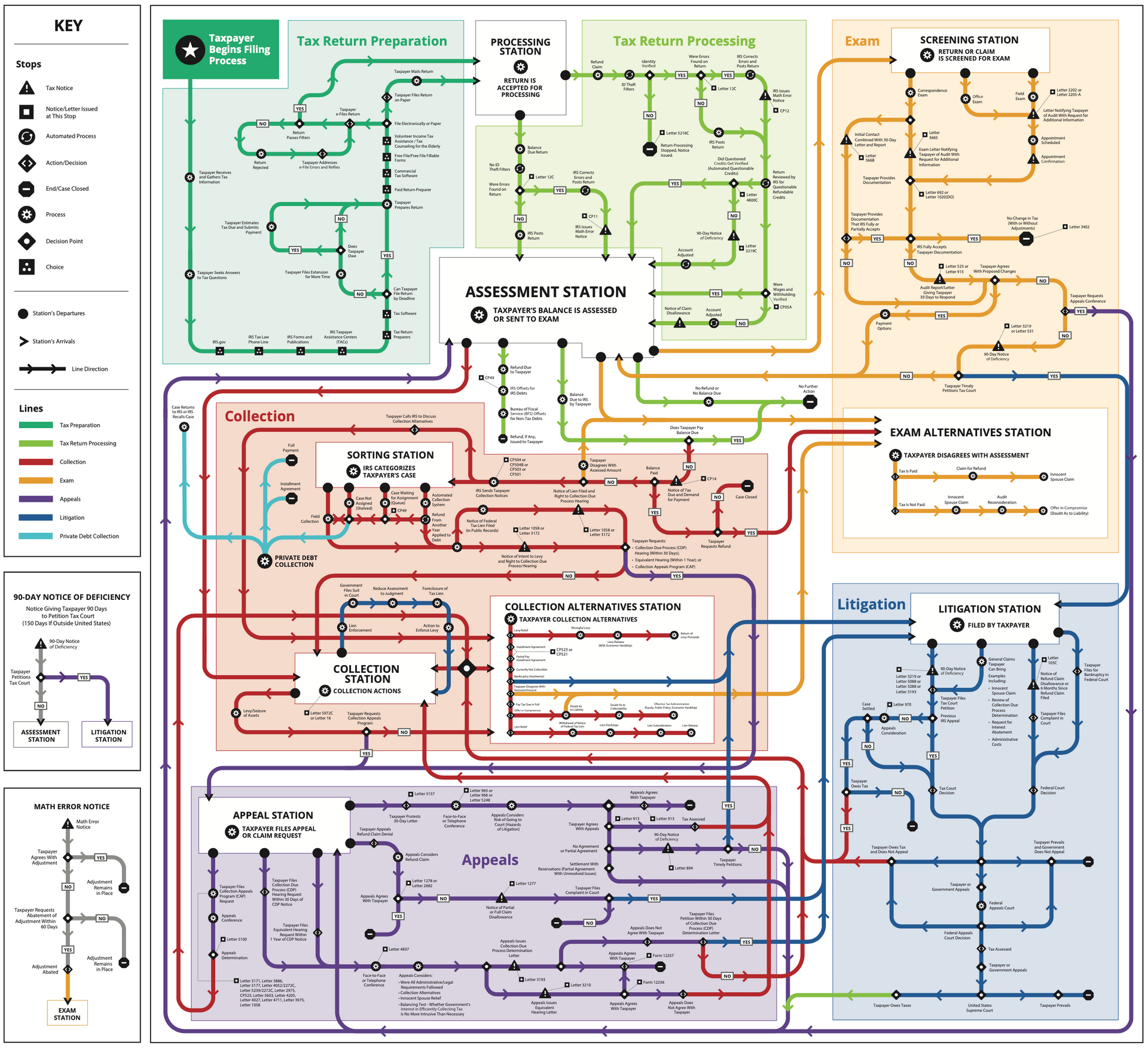

What Do I Need to Know About IRS’s tax processing?

If you are a taxpayer, you ought to study this graphic, it shows how the IRS works. And importantly, will allow you to be more knowledgeable to the myths that are popular on social media. Be careful, you must know the difference between entertainment and information. At a detailed level, you can see your journey. For more information visit: taxpayoradvocate.irs.gov

If you are an individual, what is a way to save?

An IRA and a HSA account.

Well, this is an example of what I have done for myself this year. I have maximized my HSA contribution earlier in the year. As you may know, this is one of the best investment accounts to have.

If you are a small business, what is a way to save?

SEP IRA - was not right for me, it may be right for you.

SIMPLE IRA - this is the first investment tool I used when I started my first law firm in 2013. In a matter of time, I was able to roll it into a different type of account. Now, I only invest in my i401k account. See below!

i401k - this is my current investment tool that I use. It has been opened up for those individuals with a small business!

What brokerage do you recommend and why?

Charles Schwab, because I was recommended by my good friend Mr. Marshall when I was a younger lawyer.

My HSA is held with Fidelity Investments. In addition, I do hold mutual funds/ investment products from American Century & Invesco.

Did you know there is a Taxpayer Bill of Rights?

The Right to Be Informed

Taxpayers have the right to know what they need to do to comply with tax laws. They are entitled to clear explanations of the law and IRS procedures in all tax forms, instructions, publications, notices, and correspondence. They have the right to be informed of IRS decisions about their tax accounts and to receive clear explanations of the outcomes.

The Right to Quality Service

Taxpayers have the right to receive prompt, courteous, and professional assistance in their dealings with the IRS, to be spoken to in a way they can easily understand, to receive clear and easily understandable communications from the IRS, and to have a way to file complaints about inadequate service.

The Right to Pay No More Than the Correct Amount of Tax

Taxpayers have the right to pay only the amount of tax legally due and to have the IRS apply all tax payments properly.

The Right to Challenge the IRS’s Position and Be Heard

Taxpayers have the right to raise objections and provide additional documentation in response to formal IRS actions or proposed actions, to expect that the IRS will consider their timely objections and documentation promptly and fairly, and to receive a response if the IRS does not agree with their position.

The Right to Appeal an IRS Decision in an Independent Forum

Taxpayers are entitled to a fair and impartial administrative appeal of most IRS decisions, including many penalties, and have the right to receive a written response regarding the Office of Appeals’ decision. Taxpayers generally have the right to take their cases to court.

The Right to Finality

Taxpayers have the right to know the maximum amount of time they have to challenge the IRS’s position as well as the maximum amount of time the IRS has to audit a particular tax year. Taxpayers have the right to know when the IRS has finished an audit.

The Right to Privacy

Taxpayers have the right to expect that any IRS inquiry, examination, or enforcement action will comply with the law and be no more intrusive than necessary, and will respect all due process rights, including search and seizure protections and a collection due process hearing where applicable.

The Right to Confidentiality

Taxpayers have the right to expect that any information they provide to the IRS will not be disclosed unless authorized by the taxpayer or by law. Taxpayers have the right to expect the IRS to investigate and take appropriate action against its employees, return preparers, and others who wrongfully use or disclose taxpayer return information.

The Right to Retain Representation

Taxpayers have the right to retain an authorized representative of their choice to represent them in their dealings with the IRS. Taxpayers have the right to be told that if they cannot afford to hire a representative they may be eligible for assistance from a Low Income Taxpayer Clinic.

The Right to a Fair and Just Tax System

Taxpayers have the right to expect the tax system to consider facts and circumstances that might affect their underlying liabilities, ability to pay, or ability to provide information timely. Taxpayers have the right to receive assistance from the Taxpayer Advocate Service if they are experiencing financial difficulty or if the IRS has not resolved their tax issues properly and timely through its normal channels..

Additional Questions

What apps do I recommend?

Co-Pilot - track your spending

Lastpass - store your passwords

Calm - great way to de-stress

Who is your favorite football team?

I love the Green Bay Packers, however I also have lots of love for the Baltimore Ravens.

Who is your favorite basketball player?

Micheal Jordan obviously, however I would put Shaquille O' Neal as my favorite!

Is the world round or flat?

Round

What is 2 + 2?

4

What places have you have been?

Not in order!

1. Iceland

2. Switzerland

3. Dominican Republic

4. Cuba

5. India

6. Mexico

7. Colombia

8. Germany

9. Netherlands

10. Belgium

11. Sri Lanka

12. UAE

13. UK

14. Trinidad

15. Peru

16. Norway

17. Sweden

18. Canada

19. Jamaica

20. France

21. Japan

22. Cayman Islands

23. Virgin Island

24. Puerto Rico

25. Grenada

26. St Lucia

27. Monaco

28. Italy

29. Barbados